How to Find the Best Health Insurance for Digital Nomads

Is having a Digital Nomad health insurance important? Well, everybody fears the worst scenario: You are abroad, have a terrible accident, need to be flown by helicopter to the nearest hospital, and then have to undergo emergency surgery. Afterward, you need to stay at the hospital for weeks, and in the end, you are faced with a hospital bill in the 5-figure USD range.

I have friends who experienced exactly that. Luckily, they had good international health insurance, got an emergency evacuation and the necessary treatment, were transported home safely, and did not have to pay anything. And that’s exactly why you need medical coverage in the form of proper health insurance.

This comprehensive guide will help you navigate through the various health insurance options available, ensuring you choose the best plan that fits your needs.

The Different Types of Health Insurance Plans

Finding the right health insurance plan that fits your needs and budget can take some time and effort, but the peace of mind you’ll get from knowing you’re covered in case of a medical emergency is totally worth it. Depending on where you call home, there are different options available. Here are the most common ones:

International Health Insurance:

Perfect for digital nomads and long-term travelers who hop between countries frequently. This type of insurance covers multiple countries and offers a comprehensive range of medical services, including emergency medical treatment, hospitalization, and medication. It’s ideal for those who need continuous coverage no matter where they are, ensuring you’re protected even when you’re living that nomadic lifestyle.

Expat Health Insurance:

Designed for those living abroad for extended periods, expat health insurance covers both medical and non-medical expenses. This includes hospitalization, emergency medical evacuation, prescription drugs, and even the loss of luggage. However, it usually doesn’t cover routine medical visits and chronic illnesses, so keep that in mind if you have a health condition that requires regular attention.

Travel Health Insurance:

A travel health insurance plan is great for digital nomads who often find themselves back in their home country. These plans typically cover short stays abroad, usually up to several weeks, making them extremely cost-effective for short trips. While they might not offer the extensive coverage of international plans, they do cover the essentials and are budget-friendly.

Local Health Insurance:

If you frequently visit or spend significant time in a specific country, a local health insurance plan might be more practical. These plans are often more affordable compared to international plans and can meet the country’s visa requirements, simplifying the application process. Plus, having local health insurance can be a lifesaver when dealing with medical bills and accessing routine check-ups and medical services in that country.

Top Digital Nomad Health Insurance Providers

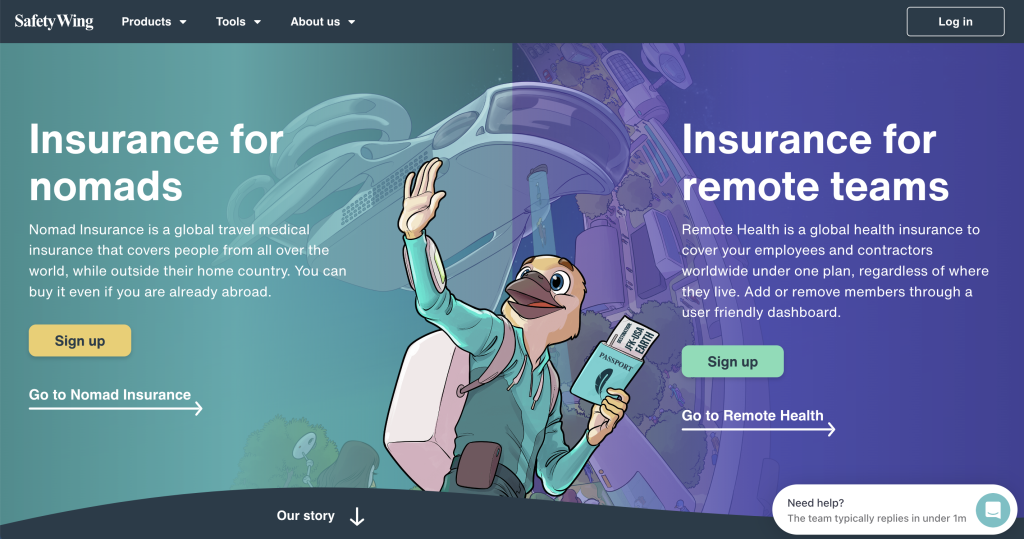

Safetywing

Pros:

- Tailored Insurance for Digital Nomads: SafetyWing specializes in providing insurance that’s specifically designed for Digital Nomads, covering medical, travel, and even remote health services. This focus ensures that the unique needs of nomadic lifestyles are adequately addressed.

- Global Coverage: One of the key advantages of SafetyWing is its global coverage, offering peace of mind to Digital Nomads no matter where their travels take them. This worldwide protection is essential for those who frequently move between countries.

- Affordable and Flexible: SafetyWing’s insurance plans are not only affordable but also flexible, allowing Digital Nomads to start, pause, and stop their coverage as needed. This flexibility is ideal for the unpredictable nature of nomadic life.

- Automatic Extension: For those who travel continuously, SafetyWing offers the convenience of automatic extension of coverage, which can be opted out of at any time. This feature ensures uninterrupted protection without the need for constant manual renewals.

Cons:

- Limited to Health and Travel Insurance: While SafetyWing excels in health and travel insurance, Digital Nomads looking for more comprehensive coverage, including gear or liability insurance, might need to seek additional policies elsewhere.

- Variable Coverage Limits: Depending on the plan, coverage limits can vary, which might necessitate a careful review to ensure that the chosen plan meets all individual needs and expectations, especially for serious medical care or emergencies.

Genki

Pros:

- Global Coverage: Genki offers health insurance specifically designed for Digital Nomads, covering medical needs in any country and allowing treatment at any licensed healthcare provider worldwide. Genki is backed up by insurance giant Allianz and offers basic and premium plans, where you can choose how much deductible you want to pay.

- Simple Online Sign-Up: The process is straightforward, even for those already traveling, ensuring Digital Nomads can easily obtain coverage without being tied to a specific location.

- No Annual Limits: Their plans come without annual limits on necessary medical treatments, providing comprehensive coverage for nomads.

Cons:

- Treatment at Licensed Providers Only: Coverage is limited to licensed healthcare providers, which might not always be convenient or accessible in remote or less developed areas.

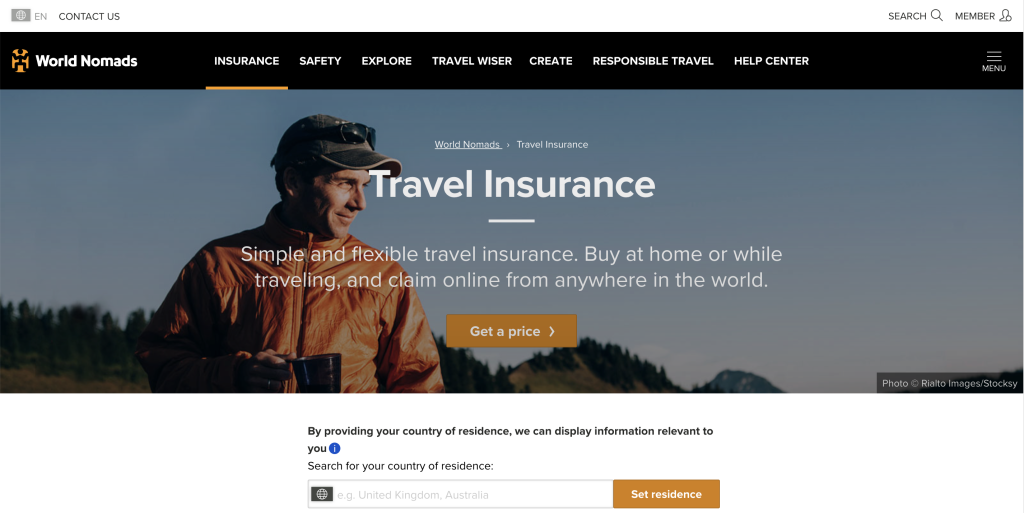

World Nomads

Pros:

- Comprehensive Coverage: World Nomads offers extensive travel insurance suitable for Digital Nomads, covering a wide range of activities and potential risks. This includes medical emergencies, trip cancellations, and gear protection, ensuring travelers are well-covered.

- Global Network: With a vast network of medical providers and support services worldwide, World Nomads ensures assistance is always within reach, no matter where you are.

- Flexible Plans: Their insurance plans are known for their flexibility, allowing travelers to extend or adjust coverage as their plans evolve, which is ideal for the unpredictable nature of nomadic life.

Cons:

- Higher Cost for Comprehensive Coverage: The extensive coverage can come at a higher cost compared to basic insurance plans, which might be a consideration for those on a tighter budget.

- Complexity of Plans: With the range of options and coverage details, some travelers might find the plans complex and challenging to navigate to find the most suitable option.

Pros:

- Tailored Insurance Plans: Hey Mondo offers a range of insurance plans, including Top, Premium, and Medical, allowing you to choose the one that best fits your needs and budget. Their coverage is comprehensive, including emergency medical and dental expenses, medical transportation, and repatriation home, among others.

- Global Coverage Options: You can select coverage for a specific country, Europe, or the world, including or excluding Canada and the USA, giving you flexibility based on your travel plans.

- No Deductibles: Hey Mondo’s insurance plans come without deductibles, meaning you can enjoy maximum coverage without worrying about additional out-of-pocket expenses in most cases.

- Innovative Features: Access to a 24/7 medical chat, online assistance calls, and an exclusive app for easy claims management and policy consultation enhances the user experience.

Cons:

- Age Limit: Coverage is provided only for travelers up to 69 years old, which may not suit older travelers.

- No Home Country Coverage: Hey Mondo does not offer coverage in your home country, which may be a limitation for Digital Nomads or expats seeking comprehensive insurance that includes their country of residence.

- Waiting Period for Late Purchases: If insurance is bought while already traveling, coverage only starts 72 hours after purchase. Also, purchasing insurance less than 14 days before your trip ends might not cover extended lodging due to COVID or necessary changes to your return flight.

Insured Nomads

Pros:

- Comprehensive Coverage: Insured Nomads offers a wide range of travel insurance solutions including emergency medical care, evacuation, trip interruption, and more, tailored for single-trip travelers, frequent travelers, and even those visiting high-risk areas.

- INC Membership Benefits: Regardless of the type of coverage purchased, all Insured Nomads policyholders receive a 12-month INC membership, providing additional benefits such as mental health support, cybersecurity, and airport lounge access.

- User-Friendly Process: The registration and insurance application process with Insured Nomads is straightforward, ensuring peace of mind for global travelers with an easy-to-use website and application steps.

Cons:

- Cost: While offering excellent protection and peace of mind, the pricing for Insured Nomads services may be higher than some individuals are willing to pay.

- App Performance: Some users have reported that the Insured Nomads app can be slow, which might be inconvenient for those needing quick access to services and information.

- Limited Physical Therapy and Chiropractic Coverage: Insured Nomads’ coverage does not explicitly include physical therapy and chiropractic services, which could be a drawback for some users.

IMG Global

Pros:

- Customizable Plans: IMG’s flagship plan, Global Medical Insurance, allows you to tailor your coverage to fit your specific needs. This flexibility is crucial for adapting to the diverse healthcare needs and circumstances of Digital Nomads and their families.

- Worldwide Coverage: You’re covered globally, which is essential for Digital Nomads who are always on the move. The plan ensures that you can receive treatment wherever you choose, giving you peace of mind during your international adventures.

- Comprehensive Benefits: The plan offers a wide range of medical benefits, from outpatient services to complex procedures, with deductible options ranging from $100 to $25,000 and maximum limit options from $1,000,000 to $8,000,000.

- Lifetime Coverage Option: If enrolled by your 65th birthday and maintain continuous coverage, you can have lifetime medical coverage, which transitions to the Global Senior Plan® at age 75 without additional medical underwriting.

Cons:

- Age Limitations: Coverage ends at age 75, and individuals 75 years and older are not eligible for new coverage, which might be a limitation for older Digital Nomads or expats.

- Eligibility Restrictions: U.S. citizens must plan to reside outside the U.S. for at least six months in the next 12 months. There are also additional restrictions for non-U.S. citizens residing in the U.S., which could affect the eligibility of some Digital Nomads.

HCI Group

Pros:

- Tailored Coverage: HCI Group provides customizable insurance plans, including NIMBL Health, which offers a modular approach to health care.

- Global Healthcare Solutions: They cater to a diverse audience, including expats, digital nomads, and marine crew, offering global healthcare plans that fit various lifestyles and professional demands.

- Personal Service: HCI Group prides itself on providing personal service, with an expert team on hand to find the best policy for individual needs, ensuring clients receive private medical care no matter where they are in the world.

Cons:

- Complexity of Choices: With over half a million possible combinations for NIMBL Health alone, some clients might find the array of options overwhelming without guidance.

- Geographical Limitations: While they cover 98% of territories outside the USA, there might be specific regions or countries with limited services or support, necessitating further inquiry for those living in or traveling to less common destinations.

Cigna Global

Pros:

- Wide Coverage: Cigna Global has an extensive network, providing access to over 1.5 million healthcare professionals worldwide. This makes it easier for policyholders to find quality care wherever they are.

- Flexible Plans: They offer a variety of plans that cater to different groups, including expats, families, and students, ensuring that there’s something suitable for nearly every need and lifestyle.

- 24/7 Support: Cigna’s services are backed by around-the-clock customer support in multiple languages, which is crucial for policyholders in different time zones needing assistance at any hour.

Cons:

- Complexity: With a wide array of options and coverage details, some might find choosing the right plan a bit daunting without thorough research or guidance.

- Cost: While not explicitly stated, comprehensive international health insurance plans like those offered by Cigna Global can be on the pricier side, especially when opting for higher levels of coverage or additional benefits.

Why Digital Nomads Need Specialized Health Insurance

The most important things for digital nomads to consider are emergency care, hospital stays, and coverage for medical costs in different countries. Regular travel insurance policies often fall short, particularly for long-term travelers or those on a digital nomad visa. Specialized digital nomad insurance offers broader coverage, including emergency coverage, dental care, and prescription medications.

Tips for Choosing the Right Health Care Solution

I recommend that you first familiarize yourself with your home country’s rules. Are you obliged to remain part of the health insurance system in your country? If not, do you lose rights once you leave? Do you want to take that risk? For us Germans, there is an obligation to have health insurance. After we became Digital Nomads, we decided to still pay for our insurance in Germany in order not to lose our rights (“Anwartschaft”). Only when we finally deregistered from Germany did we ultimately give up our health insurance there.

So far, so good. The next step is to determine which insurance features are essential to you.

1. Understanding Your Health Needs

When choosing a health insurance plan, it is crucial to consider your health needs. If you have a pre-existing condition, you will need to find a plan that offers coverage for it. If you are generally healthy and only need coverage for emergencies, a basic plan may be sufficient.

2. Considering Your Lifestyle

Your lifestyle can also impact your health insurance needs. For example, if you participate in high-risk activities such as extreme sports, you may need a plan that provides coverage for injuries related to these activities. Similarly, if you travel frequently, you will need a plan that provides coverage in multiple countries.

3. Mental Health: The Often Overlooked Aspect

Let’s not forget the mental health angle. The nomadic life, while exhilarating, comes with its own set of challenges. Juggling time zones, cultures, and the solitude that sometimes accompanies our lifestyle can take a toll. That’s why I advocate for health insurance plans that also consider mental health services. It’s not just about physical well-being; our mental health deserves equal attention.

4. Knowing Your Future Plans (roughly)

I know Digital Nomads love to be as spontaneous as possible. But in this topic, it’s helpful to know at least some essentials you want to achieve in the future. Are you planning to start a family at some point? Then, you will want a plan that provides coverage for maternity care. I can tell you from personal experience that having a child abroad can be quite an investment if you have to pay for it all by yourself.

What Emergency Services Usually Include

Typically, emergency services in health insurance plans include things like urgent care visits, emergency room trips, and ambulance rides, in case you need quick help. These services are crucial because they make sure you get immediate attention during sudden illnesses or injuries, no matter where you are in the world. It’s like having a safety net that catches you when you least expect it, ensuring you’re not left stranded in a tough spot. Always check your policy details to know exactly what’s covered, so you can roam freely with peace of mind!

What is Considered an Extreme Sport?

Extreme sports, typically seen as high-risk, can include:

- Skydiving: Leaping from a plane and free-falling before parachuting to the ground.

- Bungee Jumping: Jumping from high structures while connected to a large elastic cord.

- Scuba Diving: Exploring underwater environments, often at significant depths.

- Mountain Climbing: Scaling mountains and rock faces, sometimes at high altitudes.

- Base Jumping: Parachuting from fixed objects like cliffs, buildings, or bridges.

Insurers might view these sports differently, so it’s key to check if your health insurance plan covers such thrilling activities.

Resources for Travelers

- The world’s best hospitals worldwide in 2024

- This site has listed the emergency numbers worldwide

- First aid instructions for the 10 most common emergencies

Final Thoughts

Choosing the right Digital Nomad health insurance might seem daunting, but it’s a critical step in your nomadic journey. As someone who’s been there, I urge you to take this seriously.

I recently faced a similar situation when our health insurance provider, HanseMerkur, refused to extend our contract for another five years. We then chose to try out a local insurance provider for the time we stay in Thailand, which has been working well so far.

Dive into the details, compare travel insurance plans, and make an informed decision. After all, your health and safety are paramount, ensuring you can continue this incredible lifestyle with confidence and ease. I wish you a successful search!

Are you still unsure what nomad health insurance to choose? Leave your question in the comments, and I’ll try to help!

Thank you for reading and for making me part of your day! Yours, Lulu

Just a heads up: some links on Nomadmum.com are affiliate links. This means if you click and buy, I might earn a small commission at no extra cost to you. These earnings help keep the site running smoothly and my matcha cups full. Thanks for your support and happy travels!